How to Read a Pay Stub in 5 Simple Steps

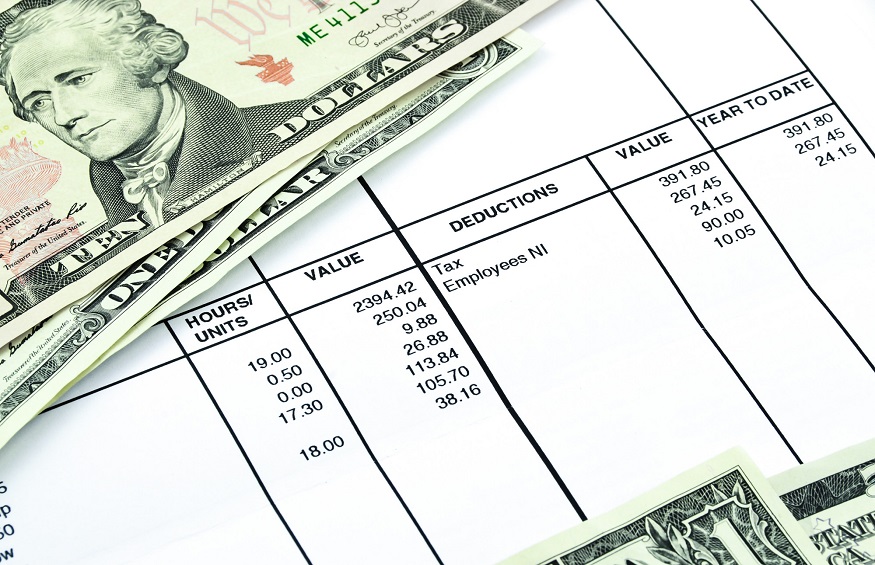

Payslip shows amount of earn with banknotes and coins

So, you’ve gotten your paycheck and you’re happy…now what? Well, your first order of business is to take a look at your pay stub. Doing so ensures that you were paid properly and that there were no unnecessary deductions taken from your earnings.

If you need a quick lesson on how to read a pay stub, this article has the answers. Check out the information below to learn more about reading a pay stub.

How to Read a Pay Stub

The information on a pay stub is sectioned off into boxes. Here’s what the sections include:

Employee Information

The boxes along the top of your pay stub include your personal information. One contains your name and address, the other has the company name and address, and you’ll also see your employee ID or social security number.

All of this information marks as an identifier to solidify that the pay stub belongs to you. Plus, it shows that you work for your employer. This is good documentation to have in case you ever have to show proof of employment.

General Payment Information

The next sections just below the top include the following:

Pay Type: This information explains whether you are an hourly or salaried employee. Some companies will also add the employee ID in this box as well.

Pay Date: Another important detail is the date. The date on a check stub keeps a record of how often you get paid, and it provides proof of steady income.

Pay Period: This explains the timeframe that you worked and also provides your pay schedule. For example, if you are paid bi-weekly, then the schedule shows a 14-day period.

Standard Wage Information

Towards the middle of your pay stub, you’ll see the number of hours that you worked. If you’re a full-time employee the standard workweek is 40 hours. Whatever the number of hours you worked will appear there.

In that same section is your pay rate. Let’s say you make $18 an hour, then your check stub will reflect that.

This box also displays your gross wages. Your gross wages are what you make before taxes and deductions are taken out. This is your base pay, not the amount that you take home.

If you worked overtime or received holiday pay, it’ll show in the same section the details listed here.

Taxes and Deductions

Your gross earnings have federal taxes, social security, medicare, and sometimes state taxes deducted from it. Plus, if you have a 401k or employer insurance, that’ll come out as well. These subtractions are generally located in the middle of your pay stub. They provide an itemized list of all your deductions.

Net pay

Net pay is the amount that goes into your pocket after all deductions are taken from your gross pay. This is the dollar amount that appears on the front of your check. It’s also the amount that you’ll receive in your bank account.

It’s important to note that all paystub layouts aren’t the same. If you prefer to create pay stubs that are customized to your liking, click the highlighted link.

Reading Pay Stubs the Simple Way

As you can see, learning to read pay stubs isn’t as hard as it seems. The information is pretty straightforward, so that it’s easy to understand. The most important thing is that you notify your employer if they are any discrepancies with your earnings

If this content helped you learn how to read a pay stub, check out more of our blog posts. Our website covers lots of content to educate and intrigue our readers.

We’re certain you’ll enjoy it!